DARKWATCH FOR FINANCIAL SERVICES

Protect Accounts, Prevent Fraud, and Secure Every Transaction

DarkWatch Helps Discover, Remediate and Prevent the Use of Stolen Login Credentials.

Know exactly when your customer or employee data appears on the dark web

Financial institutions are prime targets for cybercriminals who exploit stolen credentials to access accounts, transfer funds, and steal personal or corporate financial data.

DarkWatch™ for Financial Services helps banks, credit unions, fintechs, and insurance providers detect, remediate, and prevent the use of stolen login credentials and compromised card information before attackers strike.

The Current Threat Landscape

%

Of financial institutions have experienced a data breach involving stolen credentials in the past 24 months.

Average cost of a financial industry breach — the second highest across all sectors.

Consumers have had their financial data exposed or reused in account takeover attempts.

Get Access To The Data That Matters MOst

Why Financial Organizations Choose DarkWatch

Detect Credential and Fraud Threats in Real Time

Continuously monitor the open, deep, and dark web for compromised banking, insurance, and customer account credentials the moment they surface. Stop credential-stuffing, fraudulent transfers, and insider risk before it reaches your systems.

Filter Out Noise and Focus on Verified Risk

DarkWatch uses AI-powered deduplication and correlation to identify real exposures — not outdated or duplicate data — allowing your SOC and fraud teams to act fast on verified findings.

Meet Regulatory and Compliance Standards

Maintain compliance with GLBA, SOX, PCI DSS, and FFIEC guidelines through auditable alerts, incident reports, and response documentation integrated into your existing workflows.

Integrate Seamlessly With Your Security Stack

Plug breach intelligence directly into your SIEM, SOAR, IAM, or fraud monitoring systems through robust APIs and event feeds.

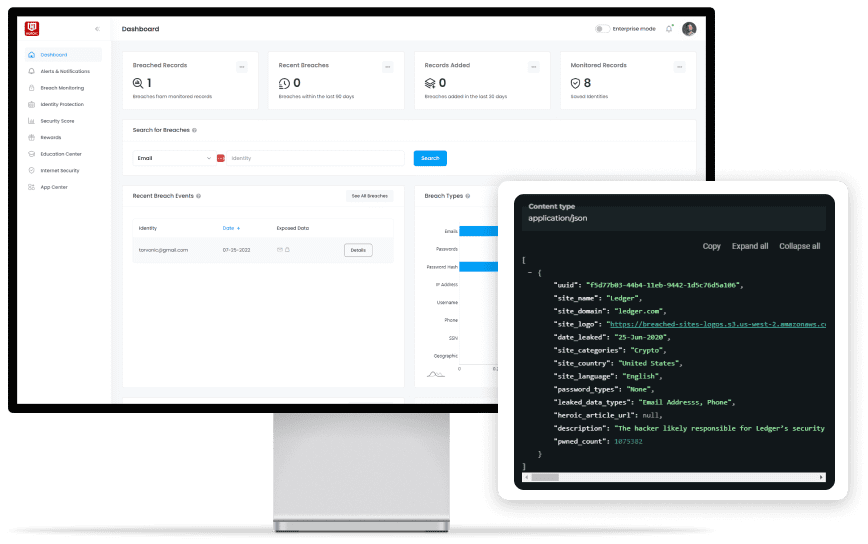

Access Full Context for Every Exposure

See complete identity data — including names, emails, phone numbers, passwords, account details, and IPs — so you can accurately assess exposure scope and respond before attackers do.

Protect the Entire Financial Ecosystem

Extend protection across employees, customers, vendors, brokers, and partners. Identify and stop credential-based risks before they lead to wire fraud or data theft.

Finance-Ready Visibility and Rapid Response

Gain instant access to verified breach intelligence and actionable exposure details.

Empower your teams to detect leaks early, prioritize incidents by financial impact, and act immediately without wading through irrelevant noise.

Every week, millions of new financial records appear on the dark web

From bank logins and credit applications to loan portals and customer support systems attackers constantly trade and reuse credentials tied to financial access.

Search and Monitor the Dark Web at Scale

Key Features

Empower your team to detect credential leaks early, prioritize incidents by clinical impact, and take immediate action.

Access the World’s Largest Database of Breached Credentials and Card Data

Gain instant access to billions of exposed credentials and millions of compromised card records collected from verified breach sources, stealer logs, and underground marketplaces. Continuously updated and deduplicated, this dataset helps you uncover compromised identities, cards, and accounts across your organization — reducing risk at scale.

Recent Breaches We’ve Discovered

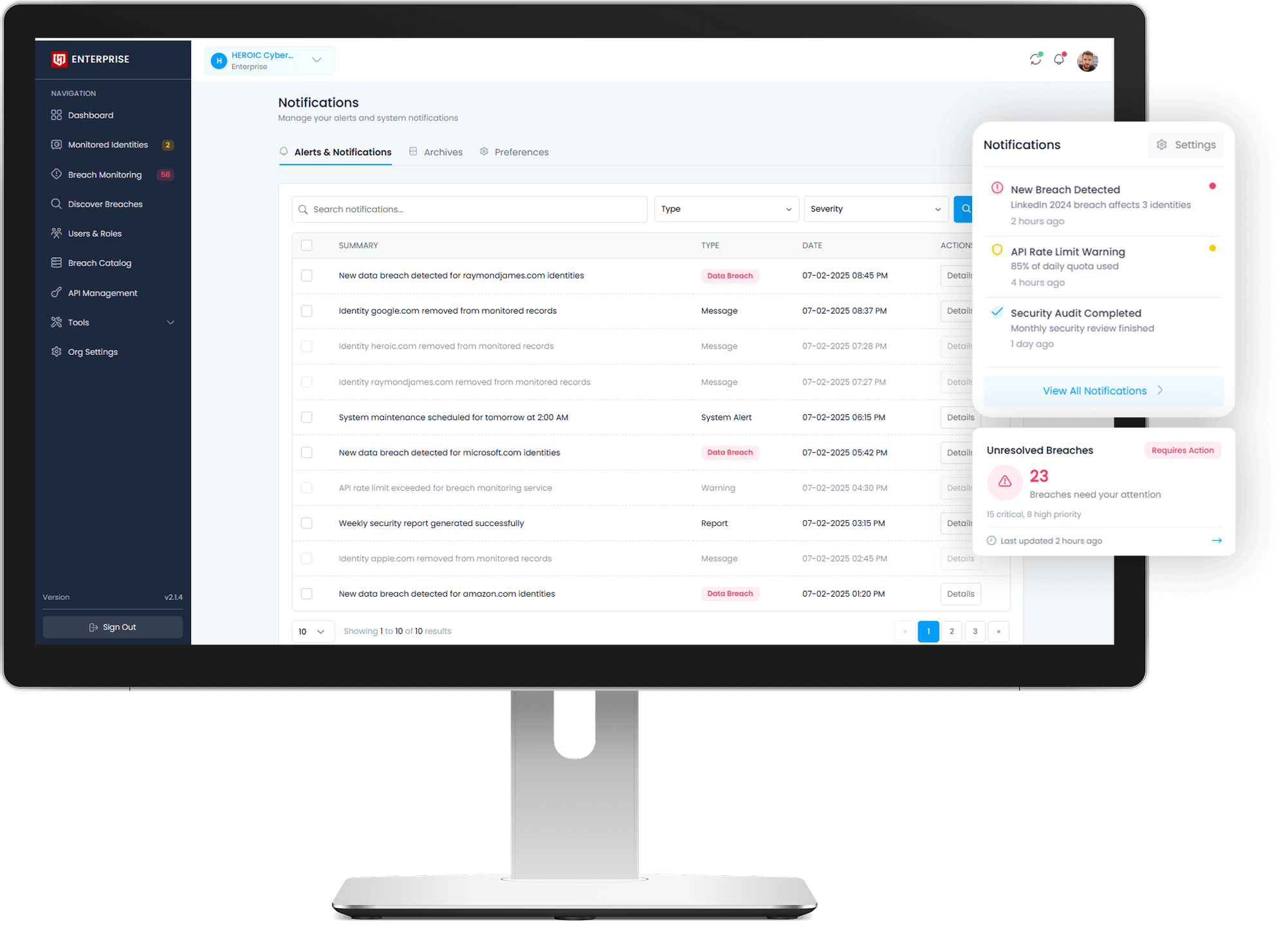

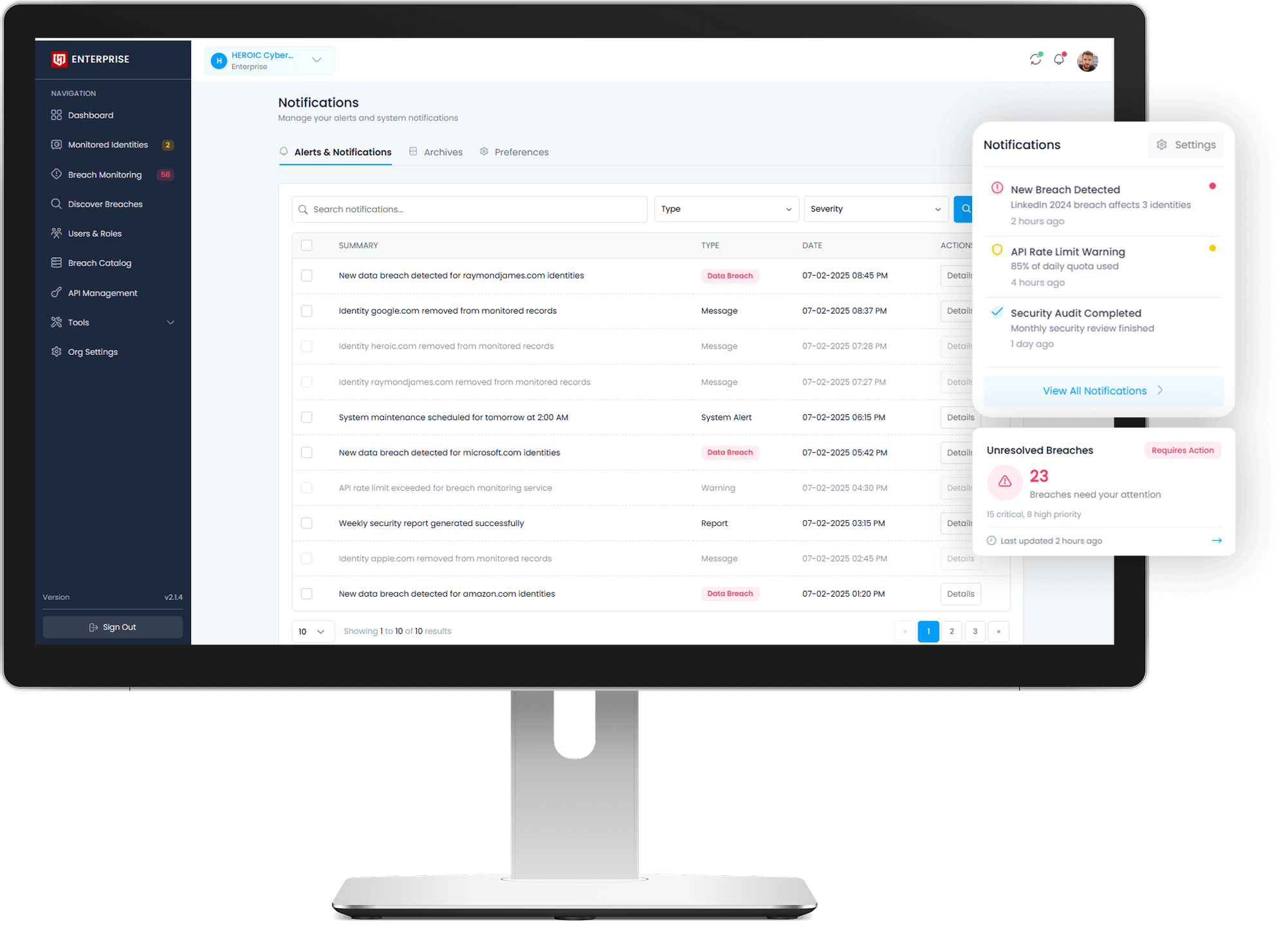

High-Fidelity Alerts, Zero Guesswork

Not all breach data is created equal. DarkWatch Financial delivers context-rich alerts that include:

-

Source of exposure (breach, stealer, card dump, or combolist)

-

Time of compromise

-

Affected identity types (employee, customer, vendor)

-

Risk scoring and recommended actions

Spend less time investigating and more time preventing fraud.

Full-Spectrum Identity and Card Monitoring

Financial institutions face risk across multiple identity and payment surfaces.

DarkWatch provides end-to-end visibility across:

- Customer emails, usernames, and account IDs

- Employee logins and administrative credentials

- Credit and debit card BINs, PANs, and tokenized identifiers

- Payment portals, online banking, and mobile apps

- Vendor and third-party system credentials

Protect every identity and transaction that connects to your financial network.

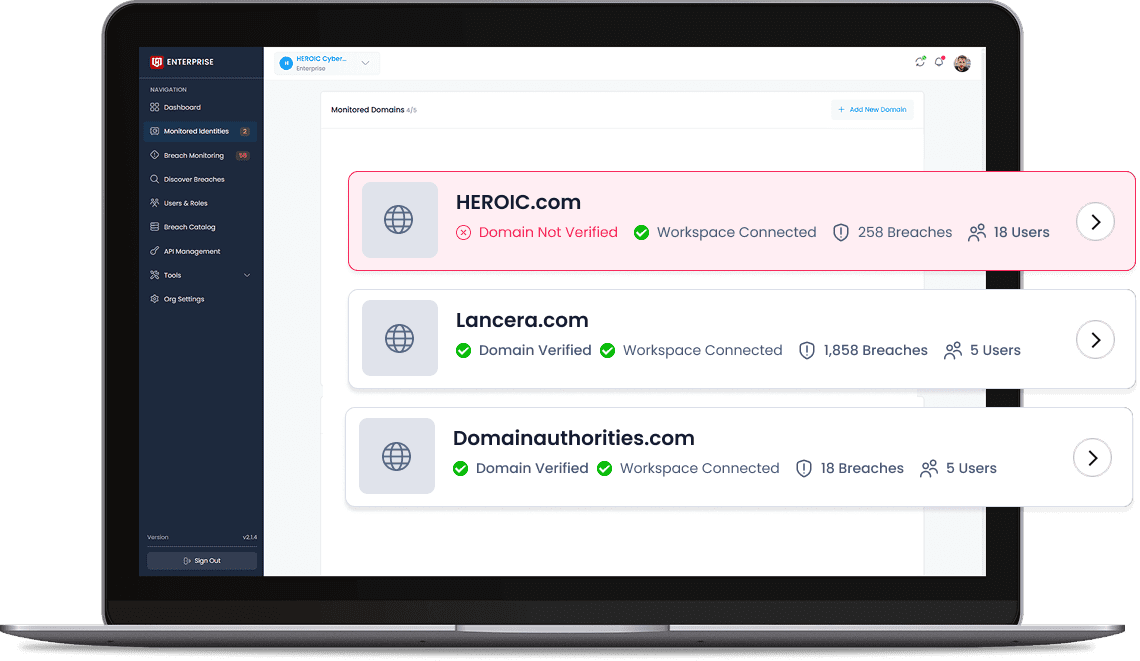

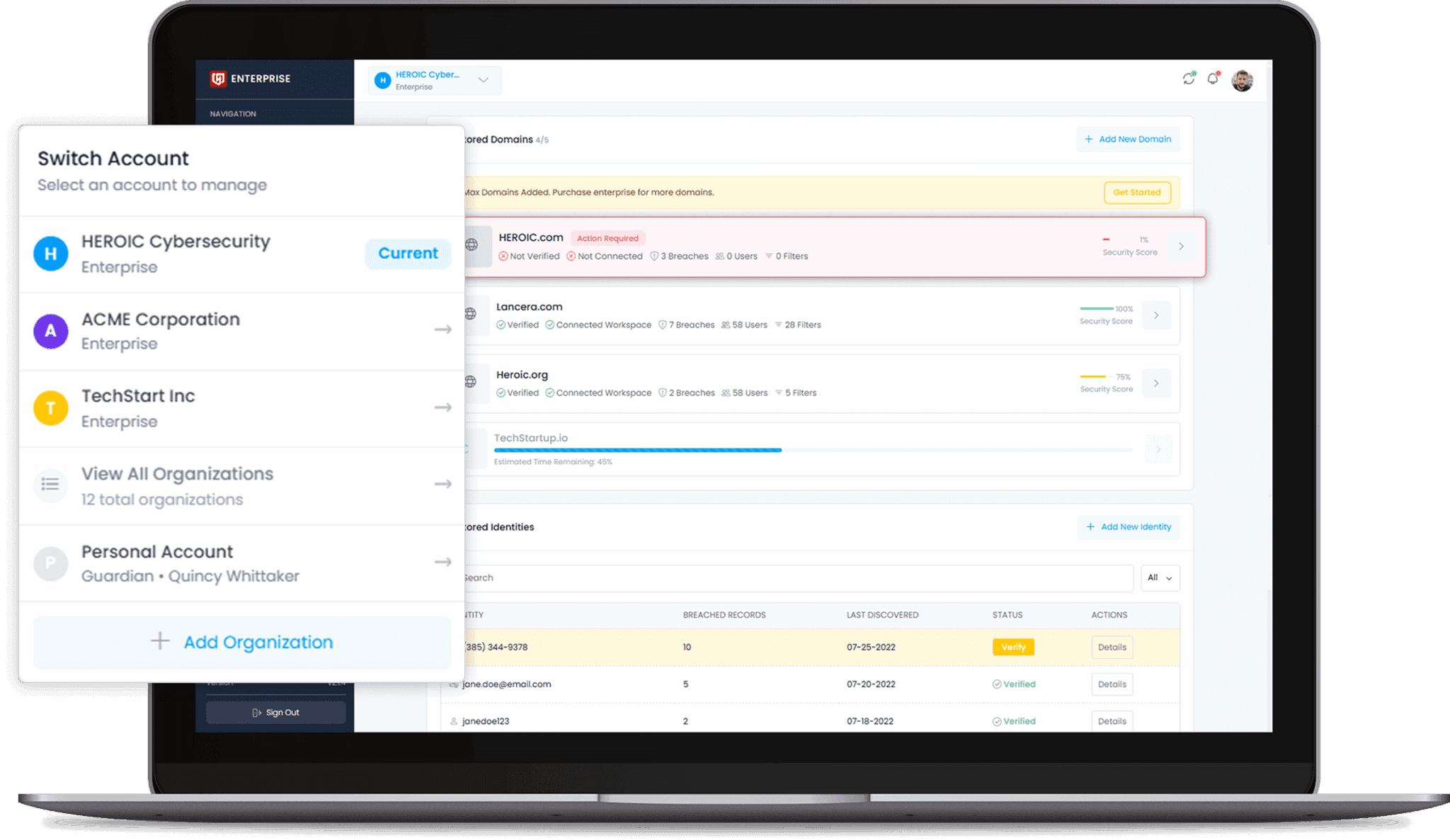

Multi-Branch and Multi-Entity Oversight

Whether you manage a regional bank, a nationwide network, or a fintech ecosystem — DarkWatch enables:

- Segmented visibility by branch, department, or brand

- Role-based access for compliance and fraud teams

- Separate dashboards for consumer, commercial, and partner accounts

Maintain clarity, compliance, and control across your entire organization.

Enterprise-Grade Breach Intelligence, Purpose-Built for Finance

DarkWatch isn’t just another dark-web scanner. It’s an enterprise-grade intelligence platform engineered for the complex, regulated, high-risk world of financial services.

Stop Guessing. Start Protecting.

Financial organizations can’t afford blind spots.

Get verified breach and card-data intelligence before attackers act and protect your customers, your brand, and your reputation.

Request a Demo or Threat Assessment Today.

Phone

1-800-613-8582

sales@heroic.com

Monday – Friday // 8:00am – 5:00PM MST

/includes/qr-code.png)